A Christmas Message

Christmas is the most beautiful time of the year! It is the time when we connect with our loved ones and everyone that shares with us our journey in Life.

It is interesting to note that when you are in the Service Industry, that is when your livelihood depends upon servicing others, your true payment comes in the form of connection and happiness when you have contributed in improving someone else's life. This gives you the energy to continue going—no matter the obstacles.

What We Do for Our Clients

Payment reduction, interest rate reduction, cash for business, buying a new property or investment, re-structuring debts, solving the problem of keeping a property, or negotiating with a partner of family member who wants to sell rather than hold, or a property needs substantial maintenance and repairs creating uncertainty as to what to do next, are examples of what we routinely do for our customers.

I mention this because in the process of helping people obtain mortgages, we have run into the above and have provided solutions that then allowed our clients to get their loans funded.

The Asset Loan—A No-Hassle Loan

What if you could walk into a bank, show them your bank statement and get immediately approved for a no-hassle mortgage?

Without having to show tax returns, explain what you do for a living, show that you are currently working or even getting paid anything, nor bring tons of paperwork or justify every single enquiry on your credit report?

Mortgage Rates the Lowest in Over a Year

You may have seen the news that mortgage interest rates recently again dropped dramatically and are now the lowest since September 2024. The Freddie Mac website currently lists the 30-year fixed rate at 6.19% (with a regularly documented, tax return loan), and 15-year fixed is even at 5.44%.

Client Testimonial—Gary

"I love Alejandro. I have a good rapport with him. I met Alejandro a couple years back on a real estate project. That deal didn’t work out unfortunately, but I kept him in mind for several years. And I called him when I had a new scenario recently, and we got it done.

“He is very professional and very personable. It’s rare to find that, I think. I find him very honest—he’s a really good guy. When I work with Alejandro, it’s fun and it feels like I’m working with a buddy.

Three Strategies to Get Control of Your Mortgage

A mortgage has 3 items that are directly under your control.

Modifying any of these items:

Changes your Rate

Changes the amount of Interest you Pay

Changes the duration of the Mortgage

The three items that are under your control and you can change are:

Comparison of the US & Dutch Mortgage Markets

My wife and I recently took a short trip to The Netherlands, where she is from. I took the opportunity to compare the US mortgage market and the Dutch mortgage market. The Netherlands has the fifth largest economy in the European Union.

Mortgage Interest Rates Are the Lowest They Have Been in 11 Months

Interest rates recently dropped again significantly, and they are now the lowest they have been in 11 months.

The Benefits of Owning Real Estate

Owning real estate has many benefits compared to other assets such as stocks, bonds or cryptocurrency. Real estate is a reliable method of growing wealth that has stood the test of time for thousands of years.

What to Look for When Buying a Home

From the many articles I have read about how to buy a home, I have never encountered this information which I learned from experience.

Buying a home is not a commodity. It is not something fungible. It is not automatic, remote, virtual, effortless, dispassionate, technological or without your active involvement.

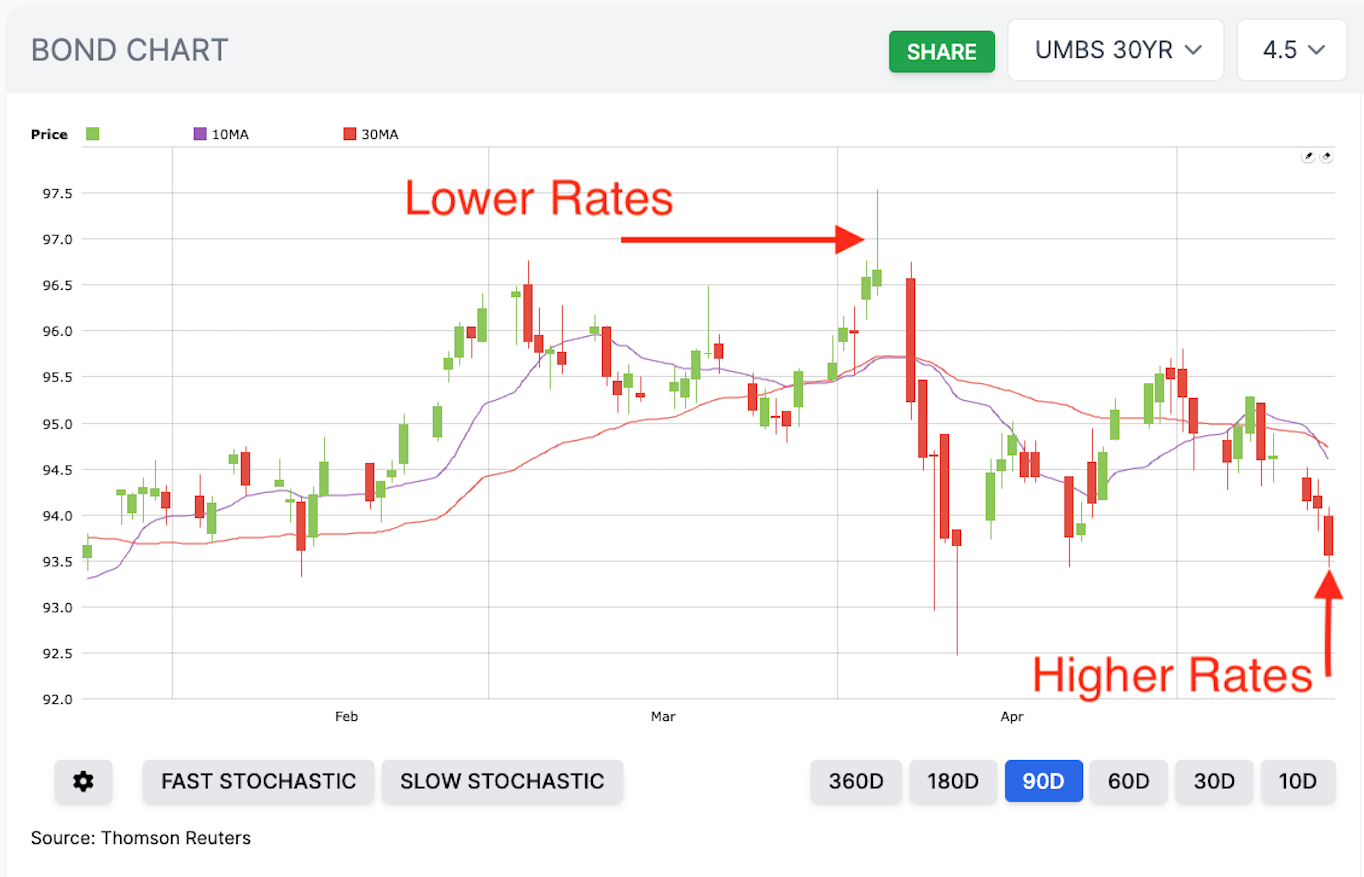

The Relationship Between Mortgage Bonds & Mortgage Rates

Today, I wanted to share something about the Bond Chart with you and how it relates to mortgage rates. Because the Bond Chart, not the rate set by the Federal Reserve, is the true key to understanding mortgage rates.

Tips for Selecting a Competent Real Estate Agent

Today I would like to take a moment to talk about selecting a good real estate agent.

It has been my experience throughout the years that people find it difficult to know whom they can trust with the sale or purchase of a home (or other real estate property), and how to determine if a real estate professional has the necessary skills to do a good job.

How to Determine the Price of a Home

When you are planning to make a real estate purchase, it is absolutely crucial that you know how to properly estimate the price of the home (or other real estate property) in TODAY’s market. You need this information not only to determine what homes you can afford and what you should offer, but also because the lender on your mortgage will send their own appraiser to estimate the value of the property, and they will not lend you more than that estimated value. (If there is a difference, you will need to come up with the difference in cash.)

How to Time the Interest Rate Market

Mortgage interest rates have been fluctuating recently. This is not talked about a lot in the media, but in the last two weeks, there was a large dip in interest rates, followed by a large surge, and then a slight decrease again.

In this email, I will explain what is causing these fluctuations, and more importantly, I will explain what you can do to catch the market at a good time.

The “Classic Real Estate” Investment Model Is Making a Comeback

One of the benefits of being a mortgage broker is that I have a front row seat to everything that is happening in the world of residential real estate and “small” business purpose real estate. By that I mean that I get to see what actual individuals and small business owners are doing in real time in terms of buying and selling homes and investing in properties. I find that very interesting.

Recent Drop in Interest Rates

Last week has seen a dramatic drop in mortgage rates.

The three main questions I receive on a daily basis are:

Are mortgage rates going to come down some more?

When will they get back to "normal"?

How do I know when rates have hit bottom?

Accompanying My Clients to the Disaster Recovery Center in Los Angeles

Last week I accompanied three of my clients to the LA Fires Disaster Recovery Center on Pico Blvd in Los Angeles. I was there to provide free assistance to them in case they needed information about the nature of their properties or existing mortgages while applying for SBA disaster loans, FEMA assistance, the Water & Power Department, etc.

Los Angeles Fires Update—Aftermath, Cleanup & Resources

Earlier this month, Los Angeles was shook by several major wildfires, all happening simultaneously. I have been working in real estate in the Greater Los Angeles area since 2006, and a number of our friends and clients were directly affected.

Now that the fires are almost 100% contained and residents have been given the green light to return to their homes in all areas except one, the work of surveying the damage, cleanup and rebuilding begins.

Client Testimonial — Marcus

“Alejandro helped me to set up passive income, because I was able to buy property. Years ago he helped me buy my first home, which I renovated, and last year I took cash out with his help. I used the money to invest, and it’s definitely helped me to do a whole bunch of stuff. I was able to buy myself a bunch of assets with that.”

The Reverse HELOC—A Line of Credit for Life

Since 2020, many housing markets have experienced a sudden home price appreciation of close to 50% (up to 100% in some markets).

If you are one the lucky ones who invested in Real Estate in 2020 or earlier, you might be sitting on a sizable amount of equity.