How It Works

A quick primer on the mortgage industry

The world of residential mortgage lending is made up of three categories of lenders:

large, mainstream institutional lenders (banks) who lend directly to borrowers

specialized institutional lenders who only lend to borrowers through mortgage brokers

non-institutional private hard money lenders (these have less strict rules for qualification but much higher interest rates, so you generally want to avoid these unless absolutely necessary)

If you are an employee with perfect tax returns, perfect or near-perfect credit score and of you fall within certain other parameters, then you will probably be able to find a great deal at a direct-to-borrower major lender (such as a large bank of credit union). About 30% of all borrowers fall into this category.

If you are one of the 70% who do not fall into this category (for example because you are self-employed), you may run into a situation where:

the bank (even your own bank) rejects you for any loan at all

they may say you only qualify for a very small loan amount

they may say that you only qualify for a loan with a very high interest rate

Thankfully, there are specialized lenders available with niche loan programs that you can access through a mortgage broker. At Prosperity Lending, we are a mortgage brokerage specialized in self-employed borrowers. We know which lender to use for which loan scenario, how to package your loan application, and how to structure your loan so you can get the most benefit out of it for the long term. We have a 96% approval rate on loan applications submitted to lenders.

“With traditional lenders the process stalled, but with Alejandro he found a way to get the loan done, and in the process helped us improve our credit score in order to get the best interest rate!”

— Rex, Premium Seafood Importer & Distributor

How mortgage brokers charge

Mortgage broker can charge for their services in two ways:

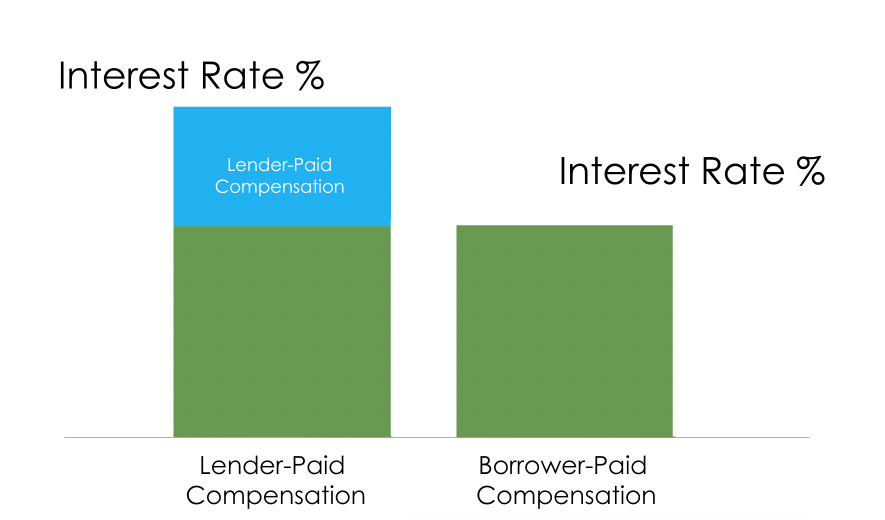

By charging the borrower a fee up front (usually expressed as a percentage of the total loan amount). This percentage is often between 1 and 3%. This is called borrower-paid compensation because the borrower compensates the mortgage broker directly for their services. Therefore, in a sense, you could say that the mortgage broker works for the borrower and not for the lender.

By building the mortgage broker fee into the loan. This is done by increasing the interest rate on the loan. In this scenario, the lender gets a higher interest rate on the loan, and in exchange the lender pays the mortgage broker fee on behalf of the borrower. This is called lender-paid compensation. These loans are sometimes promoted as “zero-point” loans, implying that the borrower doesn’t have to pay anything for the mortgage broker’s services, but this is misleading because the borrower pays for the service through a higher interest rate on the loan. This usually ends up costing the borrower a great deal more money over the total duration of the loan.

At Prosperity Lending we offer both options, and we receive the same fee either way (either from the lender or the borrower). After we explain the details and show our clients the numbers, almost 100% of our clients opt for borrower-paid compensation.

Mortgage brokers tend to charge a fee of between 1 and 3% of the total loan amount. At Prosperity Lending, we charge slightly above the average, and our exact fee depends on the size of the loan and the loan type (please contact us for a free quote on a specific loan scenario). We specialize in self-employed borrowers and we provide extensive service to our clients in helping them get qualified. It is common that we spend between 3 and 6 months with clients before they are ready to submit an application, helping them increase their credit score, fix credit report issues, brainstorming with them about financial structuring, and in other ways helping them get prepared. We provide these services at no cost as part of the loan application process. Our mortgage broker fee is only due for the brokering of a mortgage if and when the loan closes, and is paid through escrow as part of the loan closing costs. There are no charges before the closing of a loan.

Note: We specialize in self-employed borrowers, but anyone who would like to take advantage of our custom service or who is having a difficult time getting the mortgage they believe they deserve is welcome to apply for a loan through us.

Case studies

In-house preflighting with no impact to your credit score

Submitting random mortgage applications to different lenders can hurt your credit score and make it more difficult to get approved for a subsequent mortgage loan, especially if you get denied. Due to the semi-automated rules and procedures of most lenders, we routinely see denials of borrowers who are perfectly creditworthy!

To help avoid this, we do extensive in-house preflighting of your scenario before we submit your loan application to any lender. This includes a soft pull of your credit report, which is free of charge and does not impact your credit score. We know which lenders are best for specific loan scenarios and borrower types, and we know how to package loan application files so that they are easy for those lenders to digest. This is not a guarantee of approval, but it does substantially lower the risk of rejection. Since we have been in business, we have a 96% approval rate on loans submitted to lenders.

Knowledge & experience

Alejandro Szita has been solving out-of-the-box real estate problems since 2006. He enjoys challenges, especially when it comes to helping self-employed borrowers achieve their goals. He uses a network of 15 specialized lenders to get his clients the loans they need.

Before starting his mortgage brokerage, Alejandro worked as a commercial and residential real estate agent and real estate broker in Southern California for over 10 years. He learned the ins and outs of residential purchases and sales as well as commercial purchases, sales and leases, and he also raised capital for a real estate fund for several years. He has extensive experience with a wide range of transaction scenarios, both as a real estate broker and as a mortgage broker.

He is licensed as a mortgage broker in California, Florida, Oregon and Tennessee, and as a real estate broker in California.

Our loan process

We use a unique loan process that we developed specifically for self-employed borrowers. It starts with a Free Brainstorming Consultation where we brainstorm together with you about different loan scenarios and how they could work with what you are trying to accomplish. If we come upon an option that sounds good, we move on to the next phase where we ask you for a small amount of documentation so we can show you a detailed projection of a specific loan scenario. If that all still sounds good, we move on to the next phase of collecting further documentation, and so on. See our full loan process here. Everything is done with your long-term personal and business goals in mind.

Get a Free Brainstorming Consultation

If you are interested in getting a mortgage or refinance, give us a call so we can let you about your options. We will listen to you and answer all your questions, even if you are not yet ready to move forward. No harassment, just helpful advice.

Call 310-294-9413 for a free consultation, or self-schedule an appointment online.